This article sets out a strategy to increase your charitable giving (whether by a tithe or donation). By donating out of a Discretionary Trust instead of donating your personal capacity to a Tax Concessional Charity you may be able to provide donations that are effectively tax-exempt. Even if the recipient is not a Deductible Gift Recipient, giving via a Discretionary trust achieves effectively the same outcome through a mechanism that allows you to give out of your income before it is taxed.

This is an easy and legal mechanism to significantly increase your charitable giving that every trustee of a discretionary trust should be aware of.

What is a Discretionary Trust?

A discretionary trust is an arrangement by which a trustee (individual or company) agrees to hold property (“trust property”) “on trust” for a number of potential beneficiaries (usually family members). This arrangement is often informally referred to as a family trust.[1] The property held by the trust could be a business or investment (e.g. shares or real estate).

When a discretionary trust holds property, the usual intention is that income will be derived from the trust property. Under the Trust Deed terms, the trustee has discretion as to who among the trust beneficiaries will receive trust income.

If all income is distributed prior to the end of the financial year the income is taxed in the hands of the beneficiary, at the tax rate applicable to that beneficiary. The trustee is just acting as a steward of the trust property for the beneficiaries. It makes sense therefore that tax be paid by the beneficiaries who end up with the income.

Tax exempt beneficiaries

If income is taxed in the hands of the beneficiary, and the beneficiary is tax exempt however,, then no income tax is paid on that income. The beneficiary does not need to be able to receive tax deductible donations (i.e. Deductible Gift Recipient). As long as the beneficiary is income tax exempt (for instance a ‘tax concessional charity’), then no tax is paid on the income distributed to it.

Therefore, to the extent that the trust gives to a tax-exempt entity (e.g. the family’s church) the gift is in pre-tax dollars.

Examples

Let’s say a person decides to give $1,000.00 to their church.

If they give this amount out of income that they personally derive, they would have first paid tax on the income and therefore, would have to earn approximately $1500.00 to give $1000.00. However, if the gift was given by a discretionary trust, the trust could simply give the $1500.00 before it is taxed in the hands of the person who would have otherwise received it. The gift to the charity has increased by 50%.

Example:

Allan and Tracey are married, both employed (both on a top marginal tax rate of 30%) and are considering investing. Allan and Tracey give regularly to their local church, and are part of a support team for friends of theirs doing mission work.

Instead of investing in their own names, Allan and Tracey could establish a Discretionary Trust to acquire the shares, “The A & T Family Trust.” The A & T Family Trust earns $10,000.00 after expenses in its first year.

Allan and Tracey usually give:

- $100 / week to their local church

- $40 / week to their friends in mission

Total = $7280 / year.

To give that $7,280.00, Allan and Tracey would have had to have earned $10,400.00, paying $3,120 in tax before they give.

Now, instead of giving personally, they can give through The A & T Family Trust and can increase their giving by asking themselves, “what would I have to have earned before tax to give this amount after tax?” and give that larger pre-tax amount through the Trust, with the same result, in terms of what their family is left with at year end.

Conservatively, with some allowance for costs of having a tax return prepared and lodged for the trust, Allan and Tracey could increase their giving, by giving through the A & T Family Trust as follows:

- $130 / week to their local church

- $52 / week to their friends in mission

Total = $9464 / year.

That’s an extra $2,184.00 in giving in the first year alone.

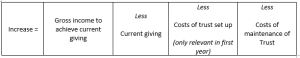

How much can a person increase their giving by?

Below provides the working for how a person can be left in the same position as they had been giving in post-tax dollars while also increasing their giving if utilising a discretionary trust:

Adding Tax Exempt Beneficiaries To Existing Discretionary Trusts

Most discretionary trust deeds include a mechanism to add beneficiaries. If your proposed charity is not listed in the existing beneficiaries, then you may need to add them as a beneficiary.

Often, this can be as simple as a resolution of the trustee. Sometimes the express consent of the Principal / Appointor is required. If your trust does not permit your proposed charity to be a beneficiary and you are considering adding a beneficiary, then you should seek legal advice.

(Care also must be taken that a beneficiary is not added as default beneficiary. This may have adverse “duty” (stamp duty) and taxation consequences. A default beneficiary is a beneficiary who is entitled to income or capital of the trust in default of the trustee exercising its discretion to distribute the income or capital. In most family discretionary trusts this is the husband and wife.)

It is important to note that adding a beneficiary does not create an entitlement by that beneficiary to the trust assets. A trustee does not have to give to all beneficiaries. The trustee has the discretion to give or not give and about how much to give.

Costs of establishment and maintenance of a Discretionary Trust

Establishing a trust is comparatively inexpensive compared with the net benefits usually derived. But all Trust Deeds are not the same. It is more expensive to amend the Deed later than get it right from the outset. Therefore, a cheap Trust Deed may not end up being cheap.

In the context of using a discretionary trust to maximise giving, prior to purchasing a trust the following should be considered:

- Whether there are provisions which assist giving to tax exempt entities.

- What asset protection mechanisms are built into the Deed?

The costs of ongoing maintenance and reporting should also be considered. This is something your regular accountant may be able to advise on.

Cautions

- All income held by a trust must be distributed to the trust beneficiaries prior to 30 June each financial year otherwise it is taxed at penal rates.

- A discretionary trust cannot be used to divert income, which is personal exertion income or income essentially and ultimately for an individual’s benefit. For example, a person cannot give money to their local church that is ultimately to be used to pay for an overseas trip for that person. This is not really a gift, but a diversion of income, that is ultimately for the person’s benefit.

- Broadly speaking, payments or transfers constitute a ‘gift’ where they are made without legal obligation, by way of benefaction and without any advantage of a material character being received in return.

For more information regarding Increasing Giving via Discretionary Trusts

Please contact our Business Development Team or call us on (07) 3252 0011 to book an appointment with one of our specialist Commercial Lawyers today.

[1] Although discretionary trusts are often informally referred to as being ‘family trusts’ (largely because families utilise them), the term ‘family trust’ has a technical meaning per Schedule 2F, subdivision 272D of the Income Tax Assessment Act 1936 (Cth). A ‘family trust’ in this technical sense is discretionary trust in respect of which a family trust election (FTE) has been made and certain relevant tests have been passed in respect of the identity of the beneficiaries and control of the trust. These ‘family trusts’ are able to access certain taxation concessions and have different rules regarding distribution requirements compared to ordinary discretionary trusts.