From 1 November 2021, all company directors are required to verify their identity with the Australian Business Registry Services (ABRS).

Once the ABRS is satisfied with a director’s identity, it will issue a Director Identification Number (DIN). Each director will only have one DIN even if they have multiple directorships, cease being a director at one company and take up directorship at another, change their name, cease being a director, or move overseas.

Why are Director Identification Numbers Needed?

The DIN requirement have been brought in to improve director accountability and transparency across corporate entities. The change seeks to limit the ability of company directors to avoid liability via illegal phoenixing activity. It is intended that this increased transparency will enable regulators to better identify and prevent fraudulent activities and protect any abandoned underpaid employees and/or suppliers of a phoenixed company.

Who needs to apply for a Director Identification Number?

The Corporations Act 2001 (Cth) requires an ‘eligible officer’ to have a DIN.1 An eligible officer includes directors of:

- Companies;

- Aboriginal and Torres Strait Islander corporations;

- Charities with a company limited by guarantee structure;

- Incorporated associations that trade outside their state of incorporation and are registered as a ‘Registrable Australian Body’ with ASIC;

- Corporate trustees, including corporate trustees of charitable trusts and superfunds; and

- Foreign companies registered with ASIC.

A good way to check if your structure is caught by the requirement is to:

- search the ASIC Register to see if your entity has an ACN; and

- search the ABN Register to see if your entity has an ARBN (not just an ABN).

If you entity has an ACN or ARBN it is highly likely that your directors will need to apply for DINs.

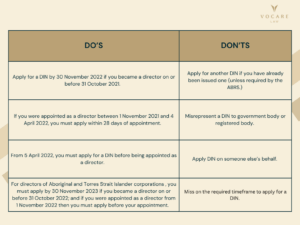

What Are the Main Do’s or Don’ts?

Failure to register for a DIN could result to significant civil and criminal penalties. The table below details the timeframe a director of the above-specified companies must apply by:2

If you are unable to apply for a DIN within the required timeframe, you can apply to the ABRS for an extension. We recommend that you take steps now to apply for a DIN or diarise to the key dates to apply for a DIN to you to avoid getting caught out.

Have a question about Director Identification Number?

If you need assistance or legal advice if the recent amendment applies to you, Vocare Law can well assist. Contact our office on 1300-VOC-LAW / 1300-862-529 or email: enquiry@vocarelaw.com.au

This article was written by Paul Neville.

**The information contained herein does not, and is not intended to, constitute legal advice and is for general informational purposes only.